The European Merchant Bank (EMBank) is committed to keeping you informed about the regulatory changes that shape the financial industry. As a specialized financial institution, we recognize the transformative implications of the proposed Payment Services Directive 3 (PSD3). With the European Commission introducing PSD3 to address gaps and modernize payment services, the directive has far-reaching implications for payment institutions, businesses, and consumers alike.

What Is PSD3?

PSD3 is the proposed update to the Payment Services Directive (PSD2), aiming to enhance the security, efficiency, and competitiveness of the EU payment ecosystem. While PSD2 revolutionized digital payments by enabling open banking and fostering competition, PSD3 seeks to address emerging challenges such as evolving fraud threats, fragmented implementation across member states, and the rise of new technologies like cryptocurrencies.

Key Innovations Under PSD3

- Enhanced Security Measures: PSD3 strengthens authentication requirements to combat sophisticated fraud schemes. It mandates advanced encryption methods and broader adoption of Strong Customer Authentication (SCA).

- Improved Open Banking Framework: The directive refines rules for third-party access to customer data, encouraging interoperability between banks and fintechs while maintaining robust privacy safeguards.

- Harmonized Supervision: By reducing regulatory fragmentation, PSD3 promotes uniformity in the licensing and oversight of payment institutions across the EU.

- Focus on Emerging Technologies: PSD3 incorporates provisions to regulate new entrants such as digital wallets and stablecoins, ensuring their integration aligns with consumer protection and financial stability goals.

Implications for Payment Institutions

- Increased Compliance Costs: Adhering to enhanced security protocols and stricter regulatory requirements will require investment in technology and training.

- Opportunities for Innovation: PSD3 opens avenues for developing value-added services like advanced data analytics, enabling institutions to better serve their customers.

- Greater Competition: By facilitating entry for new players, PSD3 challenges incumbents to differentiate through superior service quality and innovation.

- Strengthened Consumer Trust: Enhanced security and transparency under PSD3 are likely to bolster consumer confidence in digital payments, fostering greater adoption.

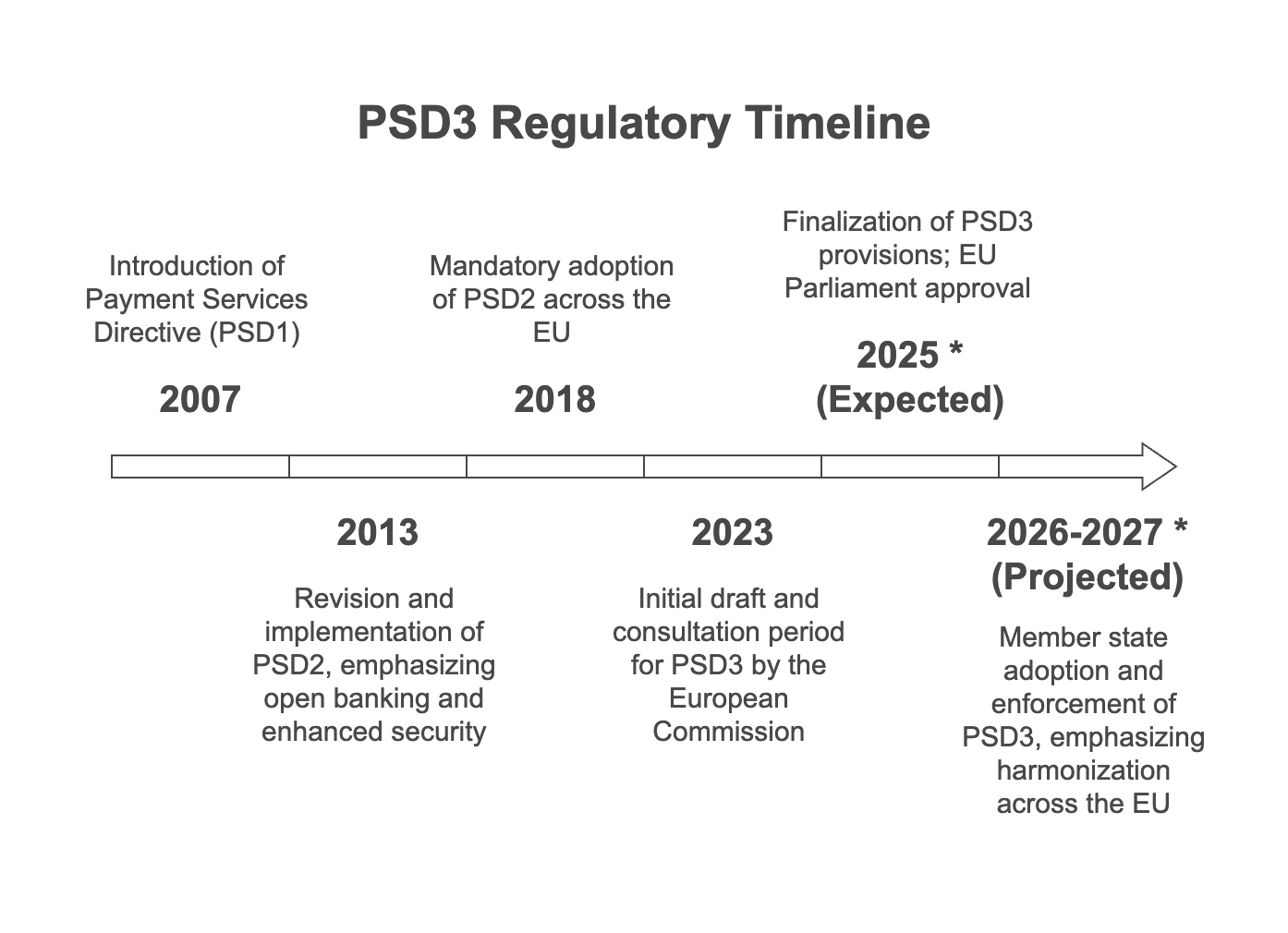

PSD3 Regulatory Timeline:

- 2007: Introduction of Payment Services Directive (PSD1).

- 2013: Revision and implementation of PSD2, emphasizing open banking and enhanced security.

- 2018: Mandatory adoption of PSD2 across the EU.

- 2023: Initial draft and consultation period for PSD3 by the European Commission.

- 2025 (Expected): Finalization of PSD3 provisions; EU Parliament approval.

- 2026-2027 (Projected): Member state adoption and enforcement of PSD3, emphasizing harmonization across the EU.

PSD3 Compliance Checklist for Payment Institutions:

- Authentication Enhancements:

- Implement Strong Customer Authentication (SCA) in all payment systems.

- Utilize advanced encryption technologies.

- Data and Open Banking:

- Ensure third-party data access complies with interoperability standards.

- Safeguard customer privacy with GDPR-compliant protocols.

- Licensing and Oversight:

- Align licensing practices with the harmonized EU framework.

- Periodically review licenses for compliance with updated criteria.

- Technological Adaptation:

- Integrate systems for managing digital wallets and stablecoins.

- Prepare infrastructure for blockchain and other emerging technologies.

- Consumer Protection:

- Develop systems to mitigate fraud risks.

- Enhance transparency in fees and payment processes.

- Documentation:

- Maintain accurate records of all transactions.

- Prepare reports for safeguarding audits as per PSD3 mandates.

- Stakeholder Training:

- Conduct regular training on PSD3 regulations for staff.

- Partner with consultants or regulatory experts like EMBank for specialized guidance.

- Regular Audits:

- Schedule annual compliance and safeguarding audits.

- Address gaps and improve practices as per audit feedback.

How EMBank Prepares

As a forward-looking financial institution, EMBank aligns its strategies with the evolving regulatory landscape. Our API-driven Banking-as-a-Service (BaaS) platform supports compliance with open banking standards, enabling seamless integration with third-party providers while safeguarding customer data. We also prioritize the security of our digital solutions by adopting cutting-edge technologies in fraud prevention and authentication.

PSD3 represents a pivotal moment for the EU payment ecosystem. By prioritizing innovation, security, and inclusivity, the directive ensures the European financial sector remains competitive in a rapidly digitalizing world. EMBank is ready to support businesses in navigating these changes, offering expertise and solutions tailored to their needs. For more information on how we can assist your business, contact us today.